Best Finance Apps for Reaching Finance Goals

It can be challenging to optimize your finances. However, you can't reach your financial goals if you don't get your finances in order. One great resource for helping you with your finances is your smartphone. These days, there are many apps out there that can help your finances in numerous ways. You should find out what the best finance apps are these days to help you meet your goals.

To put apps to use, you need to know how apps help with your finances. You should also have goals in mind that you're looking to achieve. We've compiled information about finance apps that can help you. With smartphone apps, you'll be surprised at how easy it is to improve your financial habits and stick to your budget. Give these apps a try and even your most ambitious financial goals could be easily within your reach.

10 Best Financial Apps

It's time to look at the best finance apps. Nowadays, there are so many different financial apps out there that it's hard to know which ones to use. That's why we've compiled this helpful information for you.

You can read about the ten apps mentioned below. Then, you can determine if these apps would be helpful to you in your unique position. Remember that you can experiment. Try apps out and if they aren't working for you, you can always move on to the next one. Smartphones are highly convenient in that you can quickly install or uninstall an app as you chose.

Below are ten of the best financial apps out there.

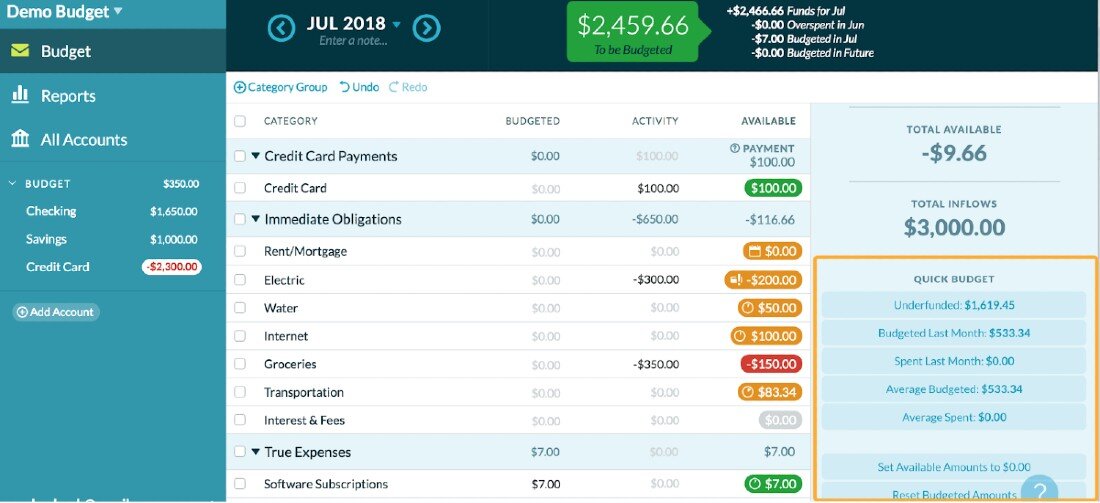

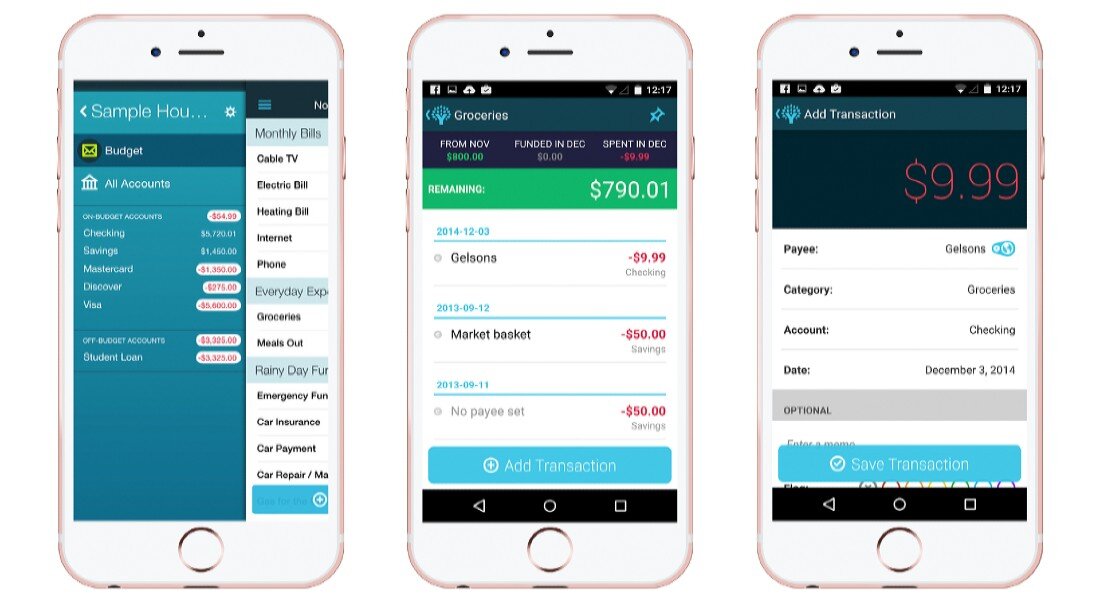

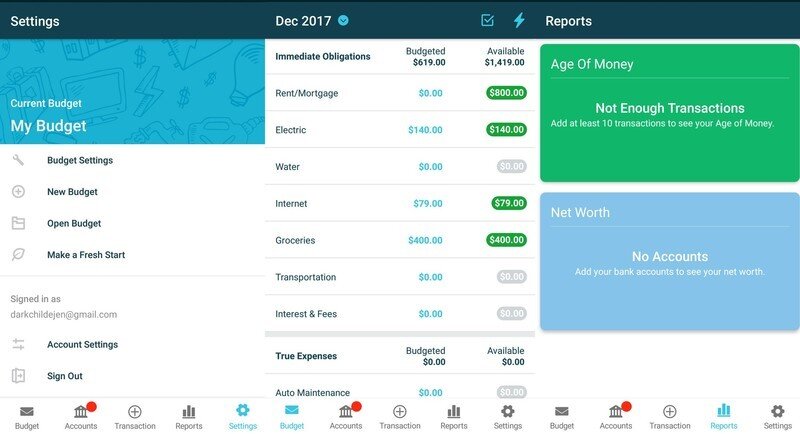

YNAB

YNAB stands for "You Need A Budget". Of course, this means that YNAB is set up to help you establish a budget. If you don't yet have a budget established, give it a try. You can also use this app to optimize your existing budget. There are some great features of this app that make staying on track easier.

For example, with YNAB, you can import checking transactions into the app. What this does is help you to analyze your spending. Statistics show that this app is helpful. YNAB has said that a typical new user of the app will save $600 in only two months of using it.

You do have to pay to use YNAB. However, the savings you can enjoy may make up for the cost. It's also worth noting that YNAB offers a free trial for the first month or so of use.

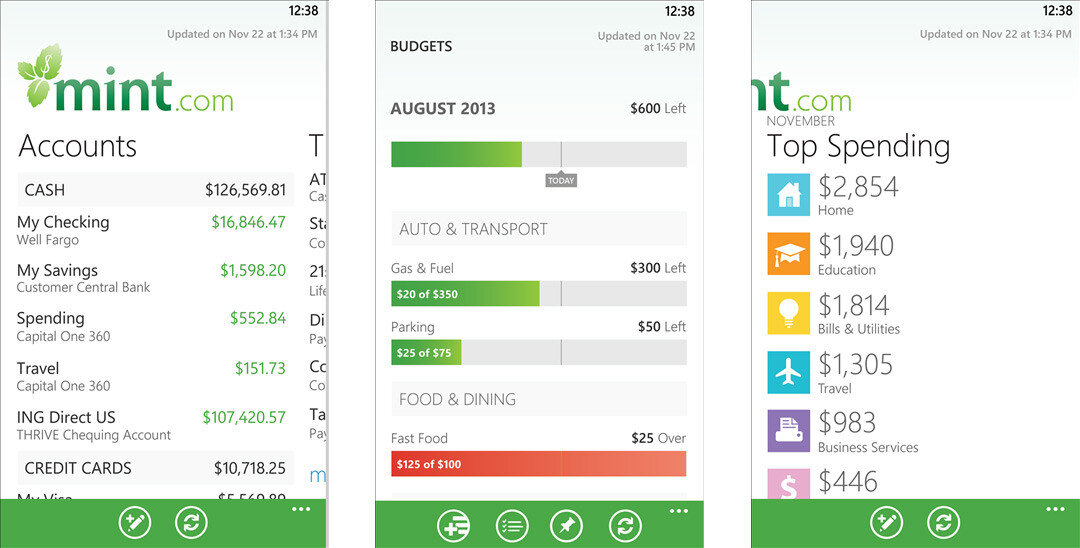

Mint

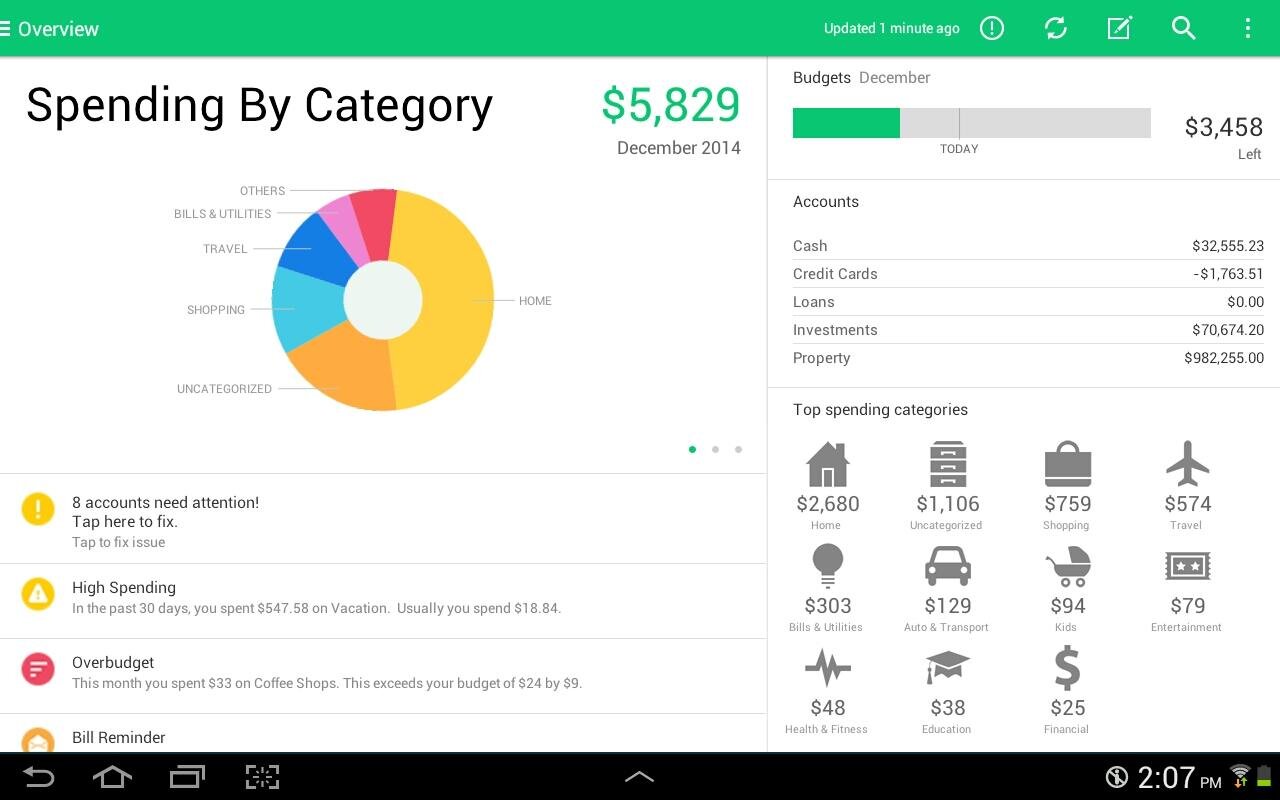

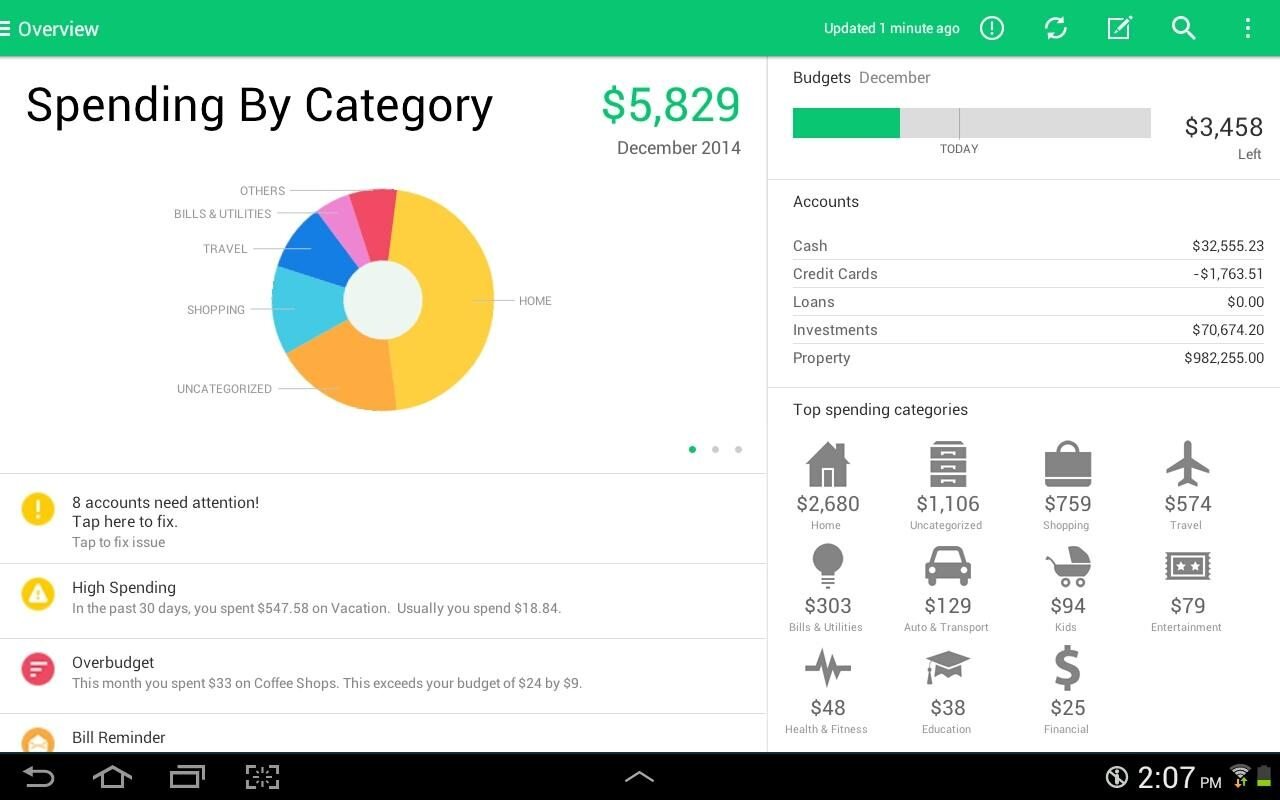

Any list of the best finance apps needs to include mention of Mint. Mint is a very successful and popular finance app. Like YNAB, Mint is a personal finance app. It helps the user to analyze his or her spending habits.

With Mint, you link your debit and credit cards to the app. Mint will then analyze your spending and track bills for you. You can figure out what types of expenses you're spending most of your money on. Another thing Mint can do is track your credit score. Mint also helps you understand why your credit score is where it is. The app provides a breakdown of what factors are improving or damaging your credit. This means that Mint can help you to reach multiple goals at once. You can use the app to both improve your budget and raise your credit score.

Mint offers both smartphone and computer access. This is a great benefit if you do a lot of work with managing your finances on your computer.

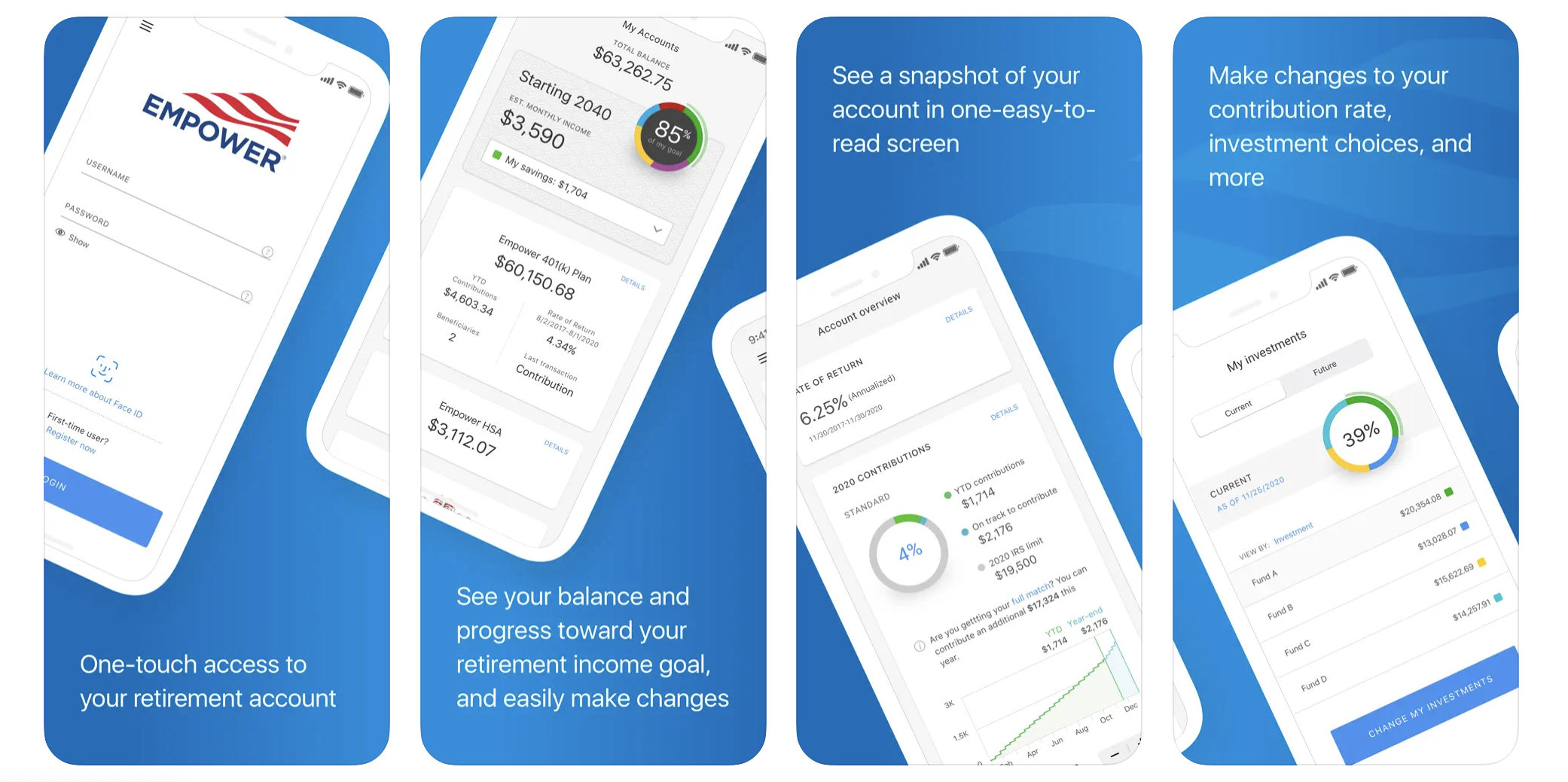

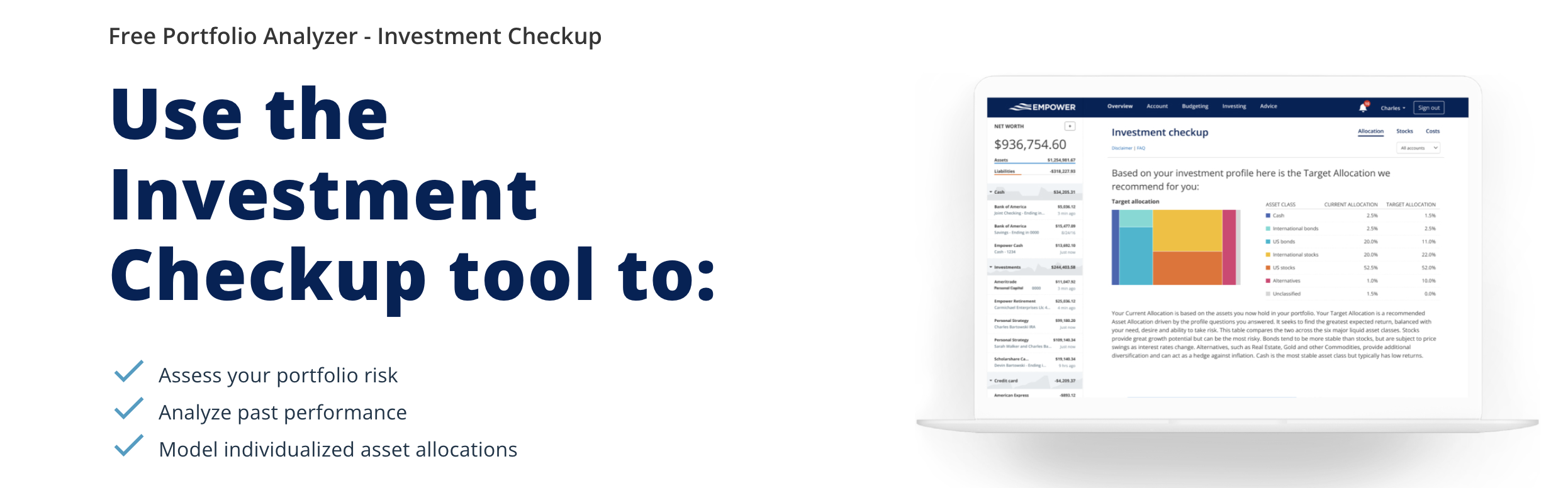

Empower

Empower is the former Personal Capital. It offers the same services and tools. You'll be automatically re-directed to the new website Empower.com where you can access your Personal Capital account.

Empower is an app that you may want to try if you want to optimize your investing. Like YNAB and Mint, Empower offers budgeting features. However, the real strength of Empower is that it allows you to analyze the performance of your investments. This means that the app will help you to get more out of your investments.

You can connect your investment accounts to Empower. In fact, the app is able to connect with accounts from over 14,000 different financial institutions. Once you've connected accounts, you can compare their performance to the performance of market benchmarks. Empower will also point out any fees or costs of investing that you are incurring.

The Empower app also helps by providing you with information. You can find financial advisors through the app who give valuable investing advice. You can also take advantage of tips on diversification or other ways to improve investment performance.

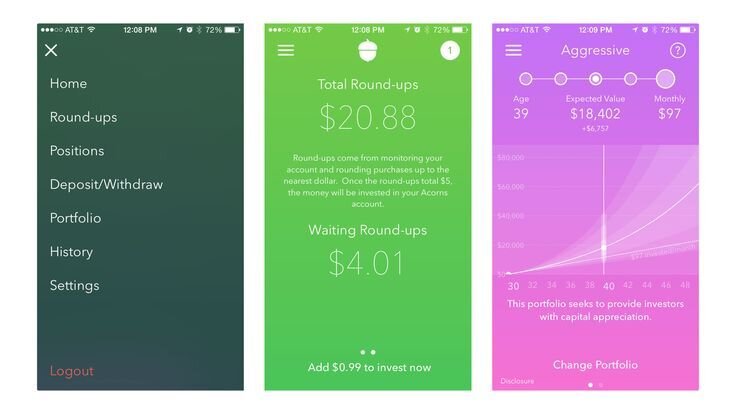

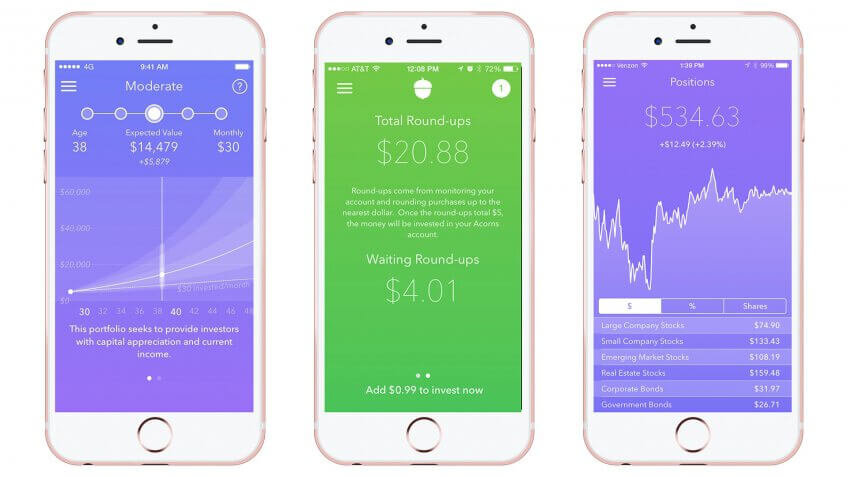

Acorns

If you want to accumulate more savings, Acorns is a good app to try out. This app will set aside funds every time you purchase something with a connected card. Acorns will round up the purchase to the nearest dollar amount. Then, the app will set the extra change aside and invest it for you.

You can choose how you want Acorns to invest your money. The app will invest in exchange-traded funds. You can select your fund of choice depending on the amount of risk you're willing to accept. In addition to choosing risk level, you can also choose between three different options.

Acorns offers the following plans:

Personal ($3/month);

Personal Plus ($5/month);

and Premium ($9/month).

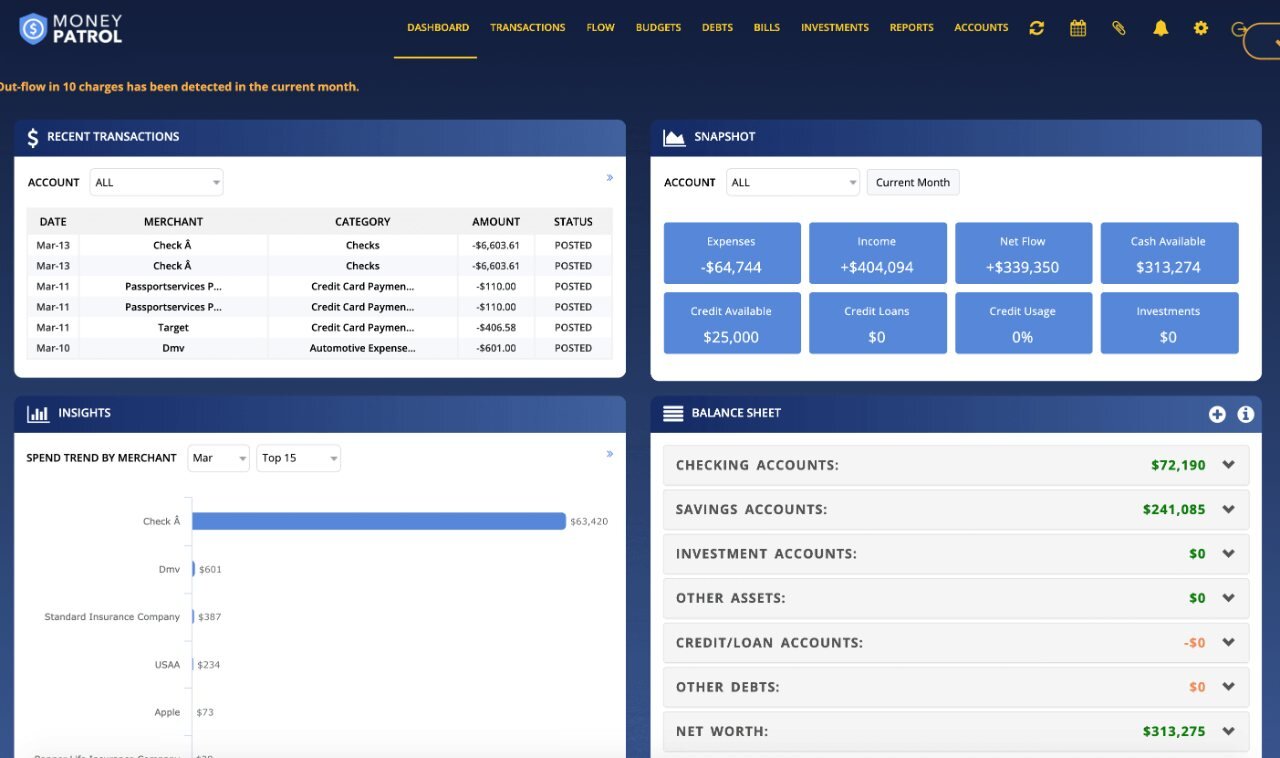

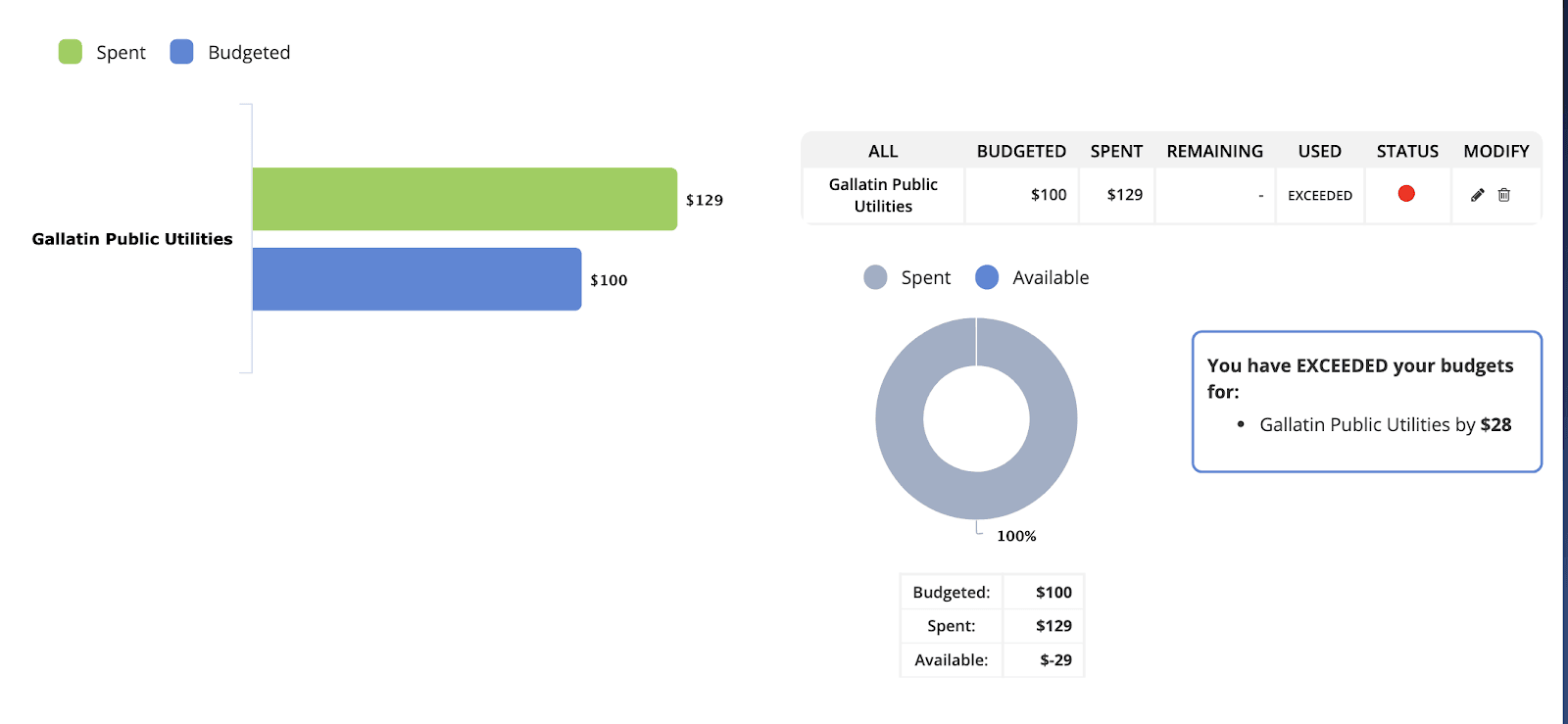

MoneyPatrol

MoneyPatrol is another budgeting app. Users can gain valuable insights about their budget using MoneyPatrol. These insights come in the form of easily understandable charts and graphs. You can use these charts and graphs to analyze transactions. You can filter data about your spending depending not only on categories, but also on individual retailers.

By setting up automatic alerts, MoneyPatrol can help you analyze your spending effortlessly. You can input your buddget specifications into the app. Then, the app will alert you whenever you are going over your budget. This makes MoneyPatrol a great way to correct bad spending habits.

Credit Karma

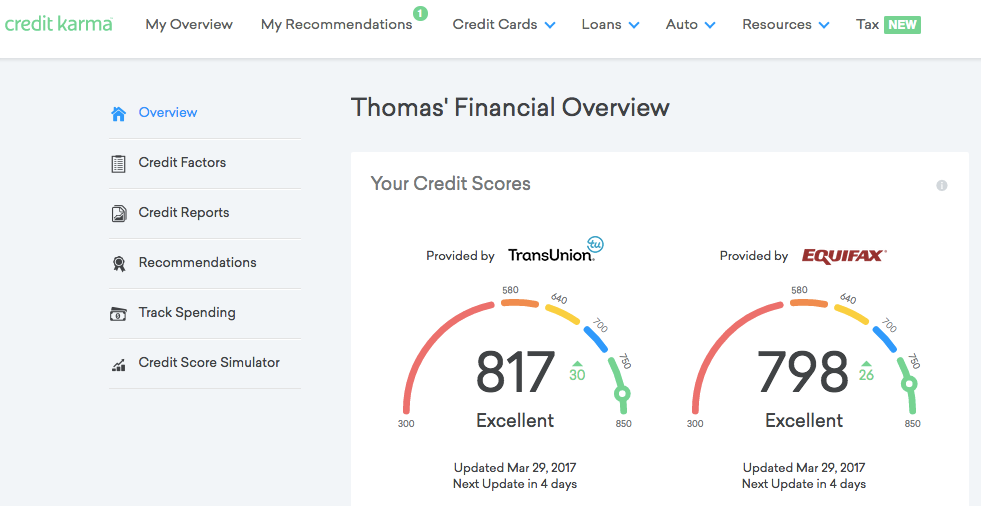

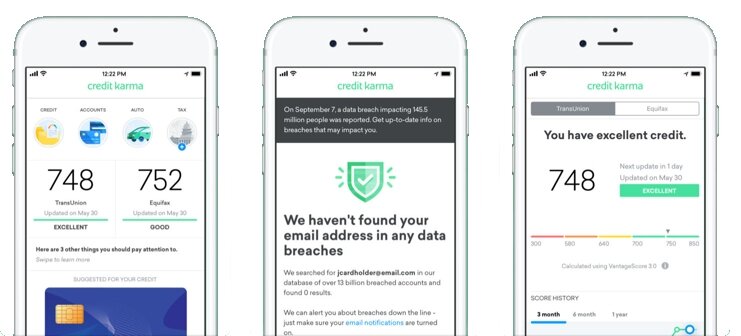

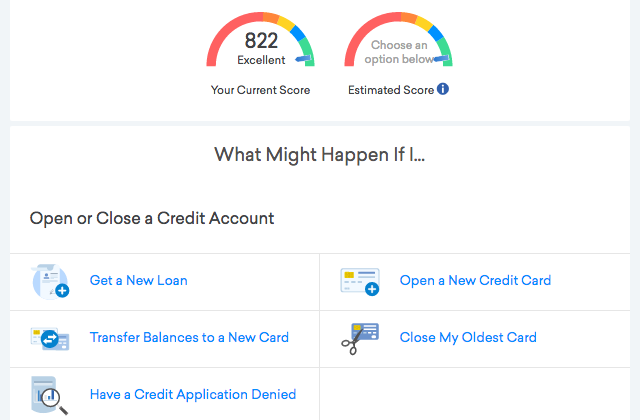

Credit Karma is definitely among the best finance apps out there if you are looking to build your credit. There are numerous features that Credit Karma offers that keep you aware of your credit. The app also presents you with many opportunities to improve your credit.

The number one function of Credit Karma is that it tells you what your credit score is. The app will find your credit score for you without damaging your credit. You won't get any negative inquiry marks on your credit report from using this app. However, you will get weekly updates regarding changes to your credit score.

Notifying you of your credit score isn't the only thing Credit karma does. The app also gives you suggestions on loans and credit cards that you may qualify for. If you are approved for credit and use it responsibly, your credit score will go up.

The Credit Karma app also offers you helpful tips on how you can improve your credit. The app analyzes the factors influencing your score. You can use this information to make improvements to your score.

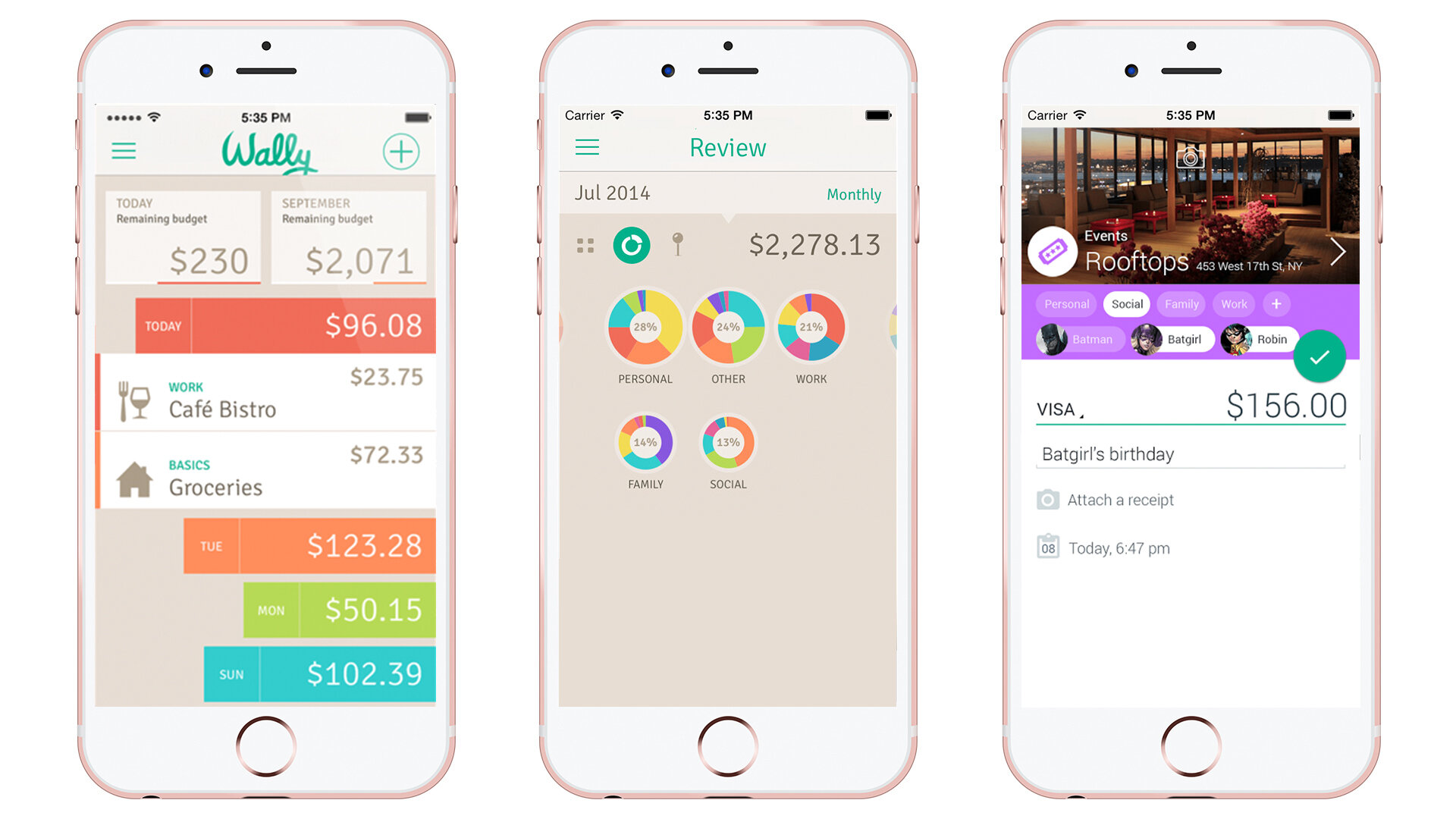

Wally

Wally is an app that will help you improve your organization when it comes to your expenses. The app does this through photos you take of your receipts. You can also use a geo-location feature that will keep track of where you're spending money.

Try Wally out and you'll be impressed by how simple to use it is. You'll also be happy to know that you don't have to pay to use Wally. The app is completely free. Surprisingly, Wally doesn't even have any distracting ads you have to look at or close out of while you're using it.

There are numerous apps out there for tracking expenses. Wally might be a better solution to some of these apps because of the ease of entering information. Many apps that track spending require you to enter information manually. With the receipt feature of Wally, you can instantly enter a significant amount of information on a transaction.

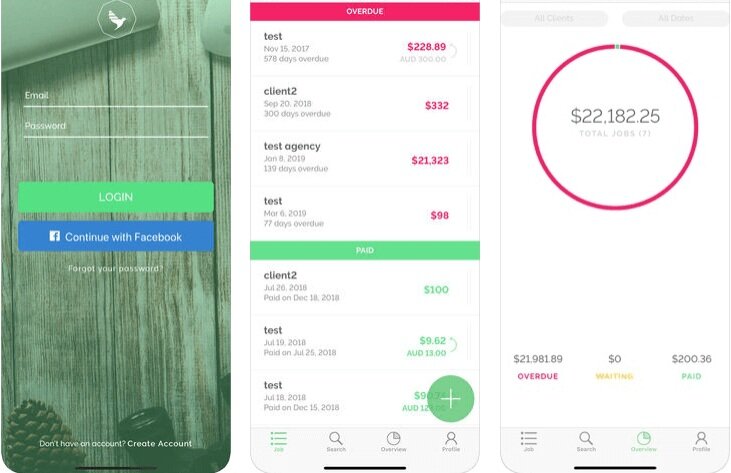

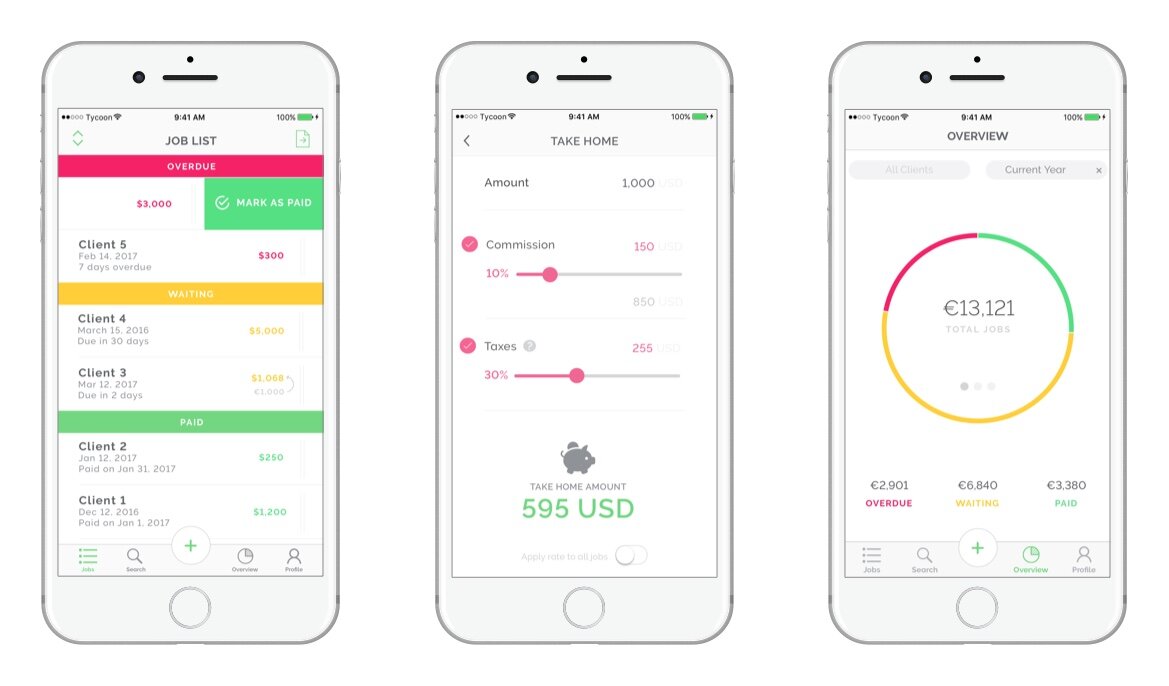

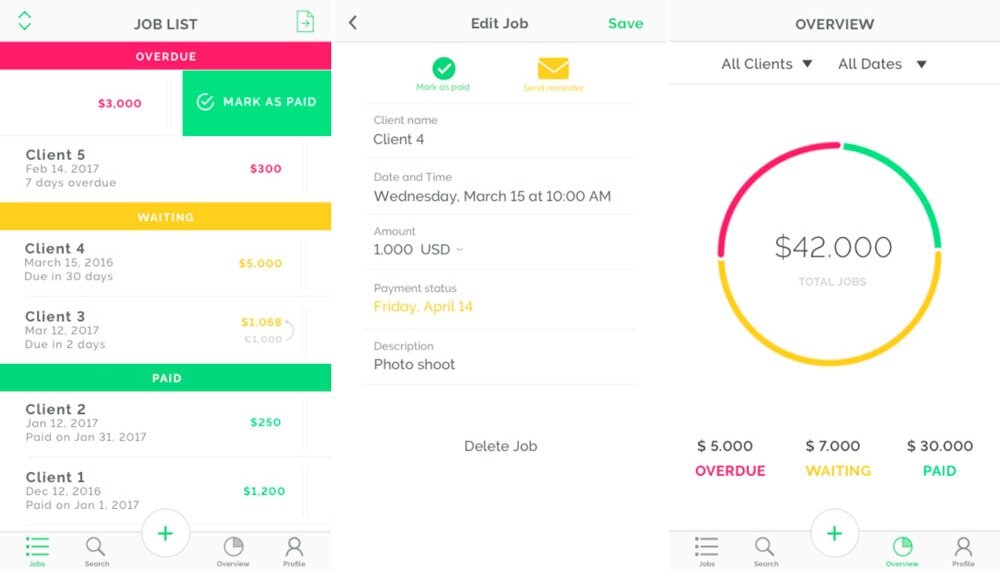

Tycoon

If you are self-employed, you might want to explore the capabilities of Tycoon. This is an app that is specifically designed to accommodate those who work in a freelance or self-employed capacity. Tycoon helps self-employed individuals to do things like calculate their take-home pay on a particular gig. This helps freelancers to know whether or not a particular gig is going to be lucrative for them. Tycoon calculates take-home pay on particular jobs by subtracting out expenses like taxes and any agent commissions.

If you're a freelancer who has frequently found himself or herself wondering about the profitability of assignments, give Tycoon a try. This app gives you valuable insights on the details of individual freelance assignments.

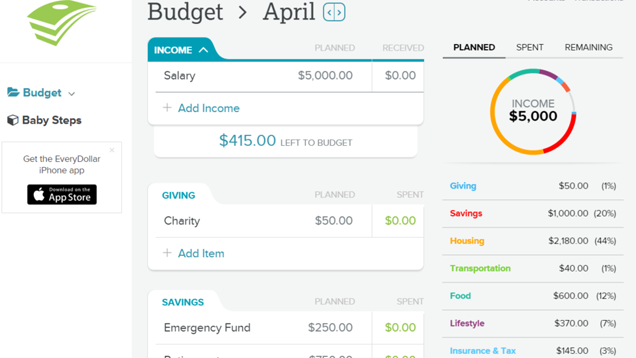

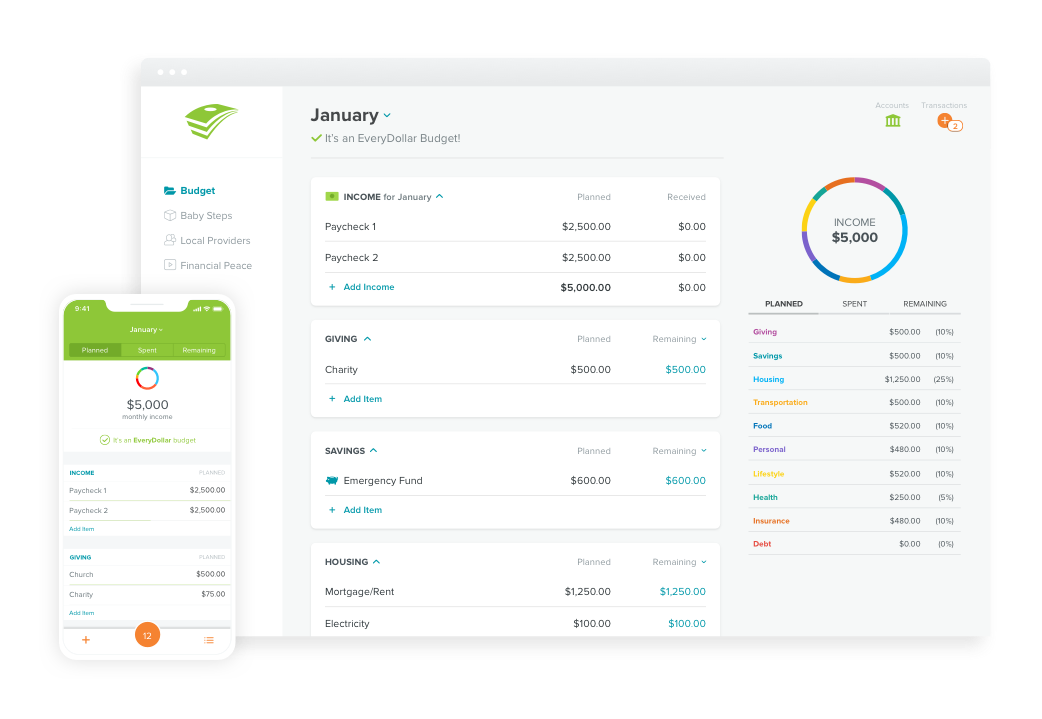

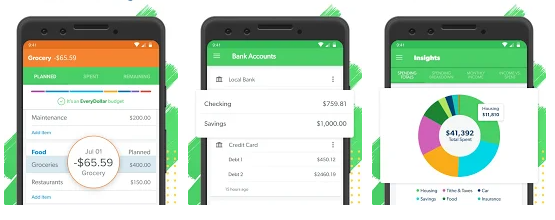

EveryDollar

EveryDollar is another app that helps you with budgeting. The app is designed around the principle that every single dollar should be earmarked for a purpose. Like some other personal finance apps mentioned here, EveryDollar can connect to a bank account. This allows the app to analyze spending. The app can track the total amount you've spent in the month. It can then tell you how much you have left for spending that month.

With EveryDollar, you can also get in touch with experts at managing money. These experts can assist you in planning out your finances. Another convenient feature of EveryDollar is that it can be used both on your computer and on your smartphone.

There is both a standard and a premium version of EveryDollar. When you first install the app, you are given the chance to try the premium version for free.

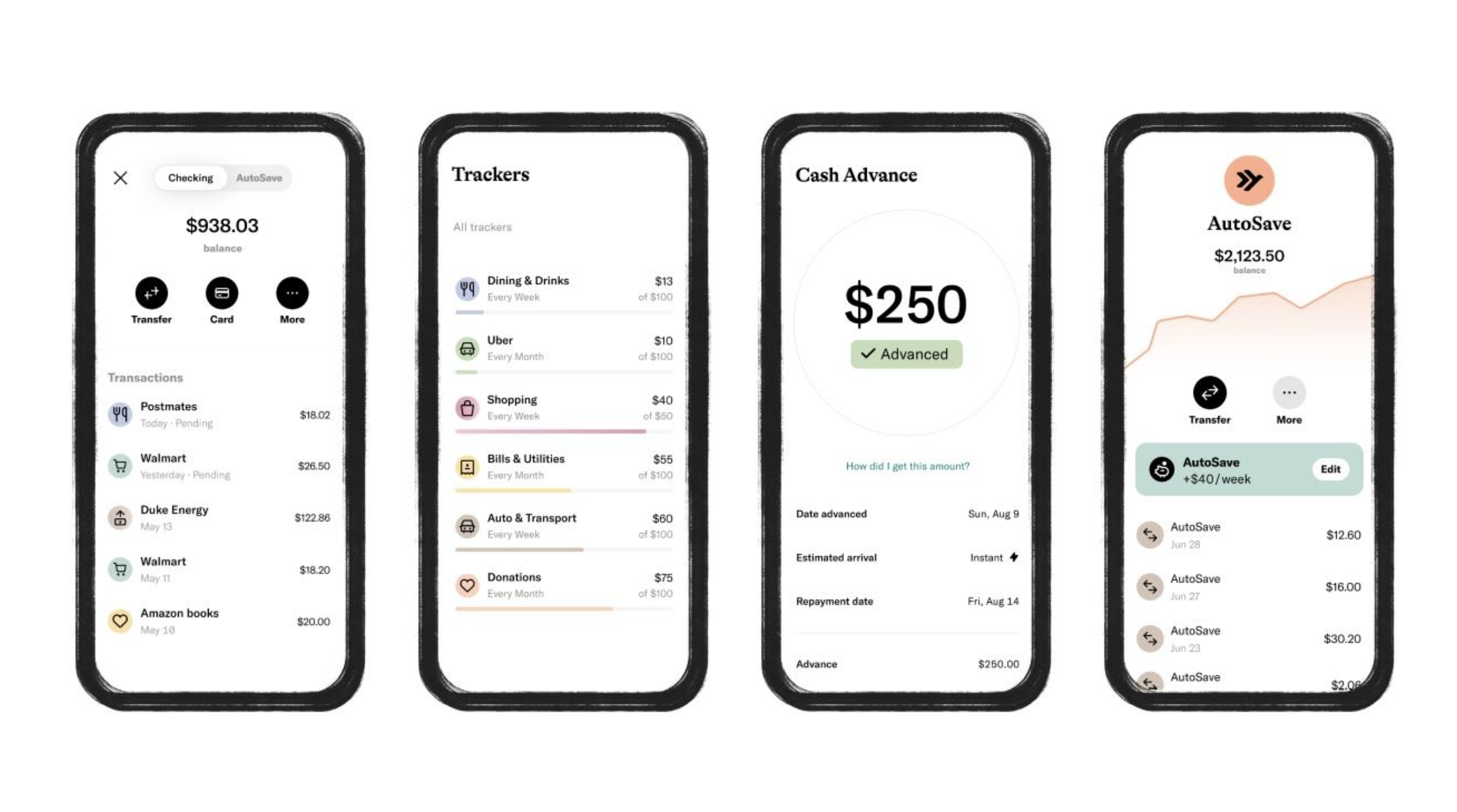

Spendee

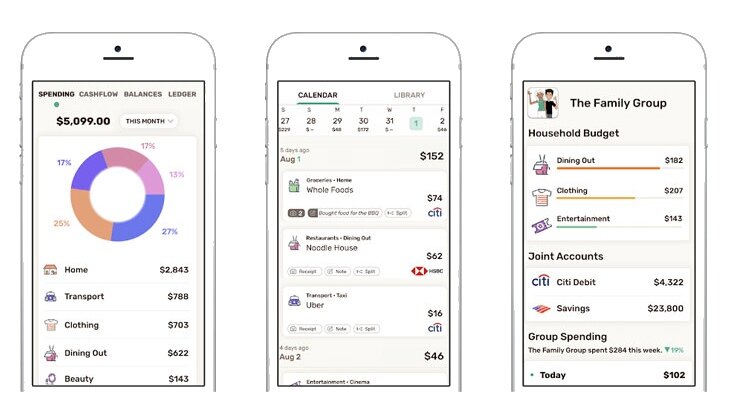

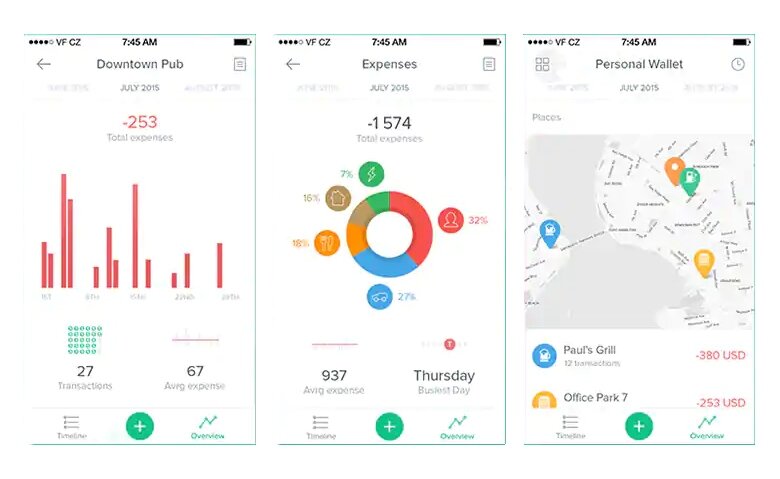

Are your finances intricately tied to those of another? If so, Spendee might be a great app for you. The other personal finance apps mentioned here are generally for individual use. On the other hand, Spendee allows numerous individuals to manage their finances together. The app does this through shared wallets. These shared wallets can be created between friends or family members.

The Spendee app is great for creating and managing a household budget. Like some other apps mentioned here, Spendee can be connected with bank accounts. This allows the app to track transactions.

With Spendee, you can create spending limits for particular expense categories. You can also set up bill payment reminders. This helps you to avoid late payment fees or dings to your credit for late payments.

Give Spendee a try if you want to manage the budget of an entire household. This app is one of the few personal finance apps designed for multiple person use.

How Apps Can Help With Your Finances?

You might be wondering exactly how apps can help with your finances. There are many things that a smartphone app can do to make it easier to manage your finances. To best take advantage of apps, you should be aware of how they can help. Nowadays, most of us are constantly referring to our smartphone throughout the day. If you're really serious about your financial goals, use this fact to help keep financial goals in your mind throughout the day.

One way that apps can help with your finances is by simply helping you do calculations. To devise a budget, you need to crunch numbers. You need to analyze how much money you earn. You need to keep track of how much money you spend. That's important for progressing financially. There are numerous apps out there that help you to determine the right budget. With these apps, you can minimize your expenses and make the best possible use of your income.

Another thing apps can do is simply provide you with information. Apps can offer advice and tips that help you determine ideal financial goals by age. They can also provide you with information about resources available from banks and other financial institutions to help you achieve your goals.

There are also smartphone apps that help by allowing you to conveniently invest. Some apps allow you to buy stocks and invest in funds from your smartphone. This makes it easier than ever to manage and grow your assets.

Goals That Financial Apps Help You Achieve

Before you choose which of the best finance apps are right for you, you need to set your financial goals. You can use apps to achieve both monthly financial goals and long term goals.

The particular goals you're working toward depend on a variety of factors. They can depend on your age and income level. They can also depend on your existing assets and financial situation.

Accumulating savings

Accumulating savings is one of the most important parts of achieving financial success. Apps help you to accumulate savings by creating a budget. They also help by making it easier to stick with your budget.

Buying a home

Many consumers hope to someday buy a home. If buying a home is an important goal for you, you should use apps to help you.

You need to save up money to buy a home. You also need to have good credit to qualify for a mortgage. Apps can help you with both of these steps for achieving home ownership.

Improving your credit

If you simply want to improve your credit, apps like Credit Karma are helpful. These apps tell you what your score is and give you advice on how to improve your score.

Managing assets

Investing your money is important. Investing puts your money to work for you. Successful investing can passively grow your money. Apps available these days make it easier than ever to invest and optimize your portfolio.

Take Finances Into Your Own Hands.

The Goalry Mall Is Here to Help.

Final Thoughts

You are now aware of what the best finance apps are out there. You're also aware of how you can use these apps. Get started today! Fortunately, a lot of apps are free to install and use on your smartphone. This makes it easy to get started.

To figure out which apps are best for you, think about your financial goals. You should always have financial goals that you're pursuing. Setting financial goals is how you move forward. You should especially look to these above mentioned apps as resources if you've been struggling to meet financial goals previously.

If reaching financial goals has proved difficult in the past, helpful finance apps may be the solution you're looking for. Give these apps a try today!