Parents, teachers, mentors, siblings, and older friends all tout the importance of financial responsibility. Few define what that actually means though. A financially responsible person pays their bills, saves about 20 percent of their income each month, and maintains a clean credit history. That still doesn’t define it; instead, it gives you goals.

Read MoreWhen it comes to divorce, you need to deal with the emotions that come with divorce, and you also have to untangle finances. The best way to prepare for the financial fallout is to know what’s coming and prepare for it.. Therefore, it’s important to understand what happens to your finances throughout the process.

Read MoreWe'll define financial resilience and create a guide that can help you get started on this process. We also include several frequently asked questions that can address concerns that many people often have when starting this process. With our help, you can get started on the path toward better financial health.

Read MoreThere are several practical, fundamental adjustments you can make to how you’re currently managing your finances and your life which can dramatically improve the odds of being able to retire early. Worst case scenario, these strategies will help you retire more comfortably whenever that might be.

Read MoreWhen it comes to issues regarding finances, most people focus on various aspects. Such aspects play a critical role in helping you understand if you are financially healthy. However, your net worth plays a central role when determining your success level in establishing your assets. If you wish to know how to increase net worth, you can continue to read this guide to uncover more.

Read MoreIn this article, we take an in-depth look at how you can take your money and put it where your mouth is by converting it into a robust financial tool. Even if you don't make a lot of money, you can still use the information in this article to get ahead. And if you're clever and take your time with these steps, you might find yourself getting more out of them than you may have anticipated.

Read MoreThe concept of being financially literate means understanding how money works and common financial practices so you can plan for your future. That goes from simply saving up for a rainy day to spending responsibly to investing wisely. If you want to save up or invest but don't know where to start, we bring you 13 books on personal finance you should read.

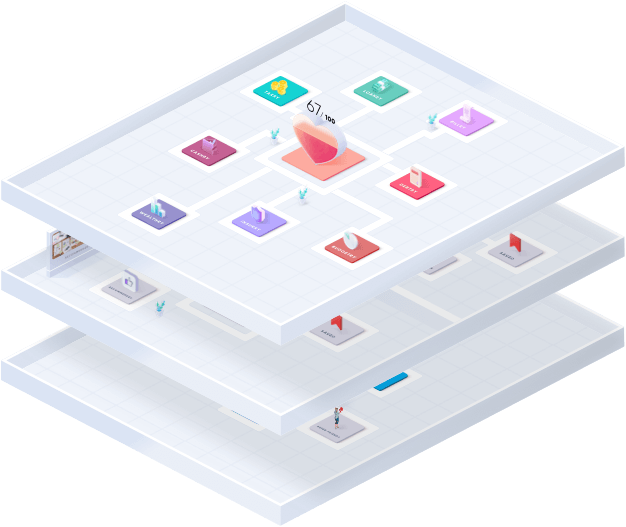

Read MoreToday we will learn a few things about how to get funding for a business at various stages in a business’s life cycle. We will first go through all the steps you need to take and then take a look at the list of 40 sources of capital that you need to know about to even think about money properly.

Read MoreIf you are financially independent, you will not have to ask for money from other people. You will have all the financial freedom to do anything you wish for as long as you can afford it. However, the road to becoming a financially independent person depends on how well you set reliable goals. In this article, you will learn about some of the ways that you can set those goals and achieve financial independence.

Read MoreIf you fail to invest in yourself, you will lose. You must take care of your health, stay engaged in life, and continue to learn. No matter how well you plan, what financial tools you use, or how much wealth you accumulate, you will not be able to enjoy your success if you get seriously ill or die. So, let’s take look at what you can do to invest in yourself.

Read More