In this article, we take an in-depth look at how you can take your money and put it where your mouth is by converting it into a robust financial tool. Even if you don't make a lot of money, you can still use the information in this article to get ahead. And if you're clever and take your time with these steps, you might find yourself getting more out of them than you may have anticipated.

Read MoreAre you tired of never having enough money? Have you worked for years and don't see the light at the end of the tunnel? If so, learning new wealth-building options will help you. These strategies maximize your potential earnings and help you fight your way out of debt.

Read MoreTo build financial wealth, you first have to understand what assets are and how to accumulate them. Certain types of assets have a certain value. Some are more valuable than others. To have a positive net worth means your assets are greater than your liabilities (debts). So let’s review the types of assets you need to build wealth and achieve your long term financial goals.

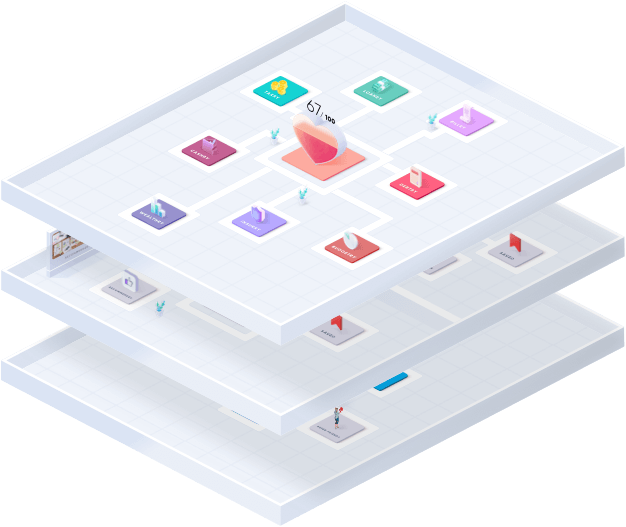

Read MoreOne of the major needs when setting financial goals is tracking them. You need to know where you stand and how far from your goal you remain.

This does not simply help you know whether you need to take on more work, it helps you show a bank or credit union that you present a credit-worthy financial situation. A personal financial statement helps you do this by helping you understand and monitor your goals.

Read MoreSetting goals for yourself is important, but making sure they are attainable is equally as important. Continue reading this article to find out more about setting proper rules and guidelines, or rules, to get you there.

Read MoreMost people want to change their financial situation. Unfortunately, they often fail because they treat the symptoms as opposed to the root cause: Their money mindset.

Your money mindset is made up of your beliefs and your attitude about money. It impacts the way you view money, feel about it, how you manage it, and more.

Read MoreIf you want to take control of your life, you will benefit from understanding and applying the principles of goal setting theory. The main premise of goal setting theory is, how well a person or an organization performs a task is directly related to goal setting.

Don't panic if you've reached your 40s and you still haven't set any financial goals for yourself. Yes, it's a little late. However, you may still have 20 years or more to work and save the money you need to achieve your goals and dreams. You can't worry about what you did or didn't do in your 20s and 30s. The time to start building wealth is now. We're going to talk about how you can start setting up your goals and then developing some strategies to meet them. You're still in the prime of your life, and there is no reason that you can't build yourself a beautiful financial future.

Read MoreYou want financial stability, but don’t know where to start. It is tough. You can make it easier though. You started making it simpler to reach your goal the minute you began studying finance.

You set personal financial goals, and you get to work achieving them. You let nothing stand in your way of achieving your goals. Draw inspiration from these personal finance goals examples.

Read MoreThe pathway towards achieving financial independence starts with having a financial plan to achieve your financial goals.

Take a look at nine super powerful techniques with the details of how to apply them that will support your success. If you use these techniques and make a habit of using them, then, over time, your life will improve significantly.

Read More