Financial Goals by 40 to Set You Up Beyond Your Middle Age

Turning 40 is one of those milestone birthdays. You look back and think just how young 20 seemed. But when you look at 60 up ahead you notice how fast the last 20 years flew by and how soon you will be middle age and beyond. By the time you get to 40 you feel like really need to have your finances in order so that you can live your best life now and look forward to the years when you are retired from the daily grind.

So what should your big picture be by the time your 40th birthday arrives? Should you concentrate on reducing debt? On adding to retirement savings? Paying off the mortgage? What about sending the kids to college? What’s the plan for that? If you want to face your best financial future here are some financial goals by 40 to set you up beyond middle age.

These are some of the common financial goals to work toward by the time you turn 40.

Emergency Savings Fund

By the time you reach 40 you should be a disciplined saver. And part of that savings should be a dedicated emergency fund. The experts generally recommend stashing away money that is equivalent to 3 to 6 months of expenses. This money should be liquid and easy to get to in case of emergency. The emergency could be a surprise layoff, an enormous transmission repair or unexpected medical expenses. Without an emergency fund you might have to go into debt to cover those kinds of things. And the idea at 40 is less debt – not more.

Retirement Savings

One of your financial goals by age 40 should be funding a retirement nest egg. Ideally, you will already have put aside 3 times your annual salary in retirement savings. If you are making $75,000 when you turn 40, you should already have $225,000 set aside in an IRA or 401(k) retirement savings account. But you can’t stop there. You have to fund retirement savings faithfully each year. The world is only going to continue to get more expensive by the time you retire and one of your financial goals by 40 is to set yourself up to retire without reducing your standard of living.

Manage Debt

By the time you turn 40 your debt will have ideally been slashed to what you owe for you home and what you owe for your car. Don’t head into your 40s with a mailbox full of credit card balances with extremely high interest rates and a statement still loaded with student loan debt. In your 40s you’ll want more of your income to go toward retirement savings or college expenses for your children. It’s okay to continue to use credit cards to maintain a good credit history, just pay the balances in full every month.

Plan for the Future

One of your financial goals by 40 is to have plans in place for the future. And for this you might need some professional assistance from a financial planner, a CPA, an insurance agent or an estate lawyer. The cost of their professional fees is likely to be worthwhile. They can offer knowledge, experience and solutions.

Have a Will

While it may be uncomfortable to think about what happens after you’re gone, especially if you’re only in your 40s, the reality is you need a will so that the heirs you leave behind don’t have to detangle a mess to receive what they are entitled to.

Review Retirement Savings Plan

A financial planning expert can run the numbers and let you know if you are on a path that saves enough money to fund retirement. That person can also show you what it would be like if you saved even more. A CPA can advise you on the tax implications of any current strategies you have in place.

Invest Your Money

The most productive place for your money is not in your passbook savings account at your local bank. Interest rates on those kinds of savings accounts are dismal. One of your financial goals by 40 should be to turn your savings into investments. You don’t have to be wealthy to begin purchasing stocks and bonds and mutual funds. In the United States the bull market has been going strong for more than a decade and investments have continually out-performed interest rates banks have been paying on standard savings accounts.

Review Insurance Coverage

One of your financial goals by 40 should be to see if the insurance coverage you had in your 30s is still what you need. Long-term and short-term disability coverage protect you if you can’t work. You might want to look at long-term care coverage that down the road might protect your savings if you have a medical issue. This is also a good time to review any whole-life or term-life insurance policies you have in place. Once upon a time you might have only taken out enough insurance to pay your funeral costs. But things might be different now. You may have a spouse and kids that will need more than that after you’re gone. And some insurance products work like investments.

Your financial goals by 40 aren’t just the ones that are a little bit sobering. Let’s assume you have a lot of living left to do but need the financial resources to enjoy it. Let’s look at how you get there as well.

Goals are an Action Plan

Simply put financial goals are the ways you want to save and spend your money. Your financial goals will be specific to your situation. They will also help you to see past the individual lines on your checkbook register. Your financial goals are a roadmap to where you want to be with your money. Financial goals fund your big picture.

How Do I Set Financial Goals?

When you are setting up your financial goals by 40 remember the strategy known as SMART. That stands for Specific-Measurable-Achievable-Relevant-Time-Bound. This isn’t a strategy just for financial goals. It may be the same strategy used on your annual performance review. There’s a reason this is a popular goal-setting strategy. It’s a straightforward method.

If one of your financial goals by 40 is to reduce your student loan debt that is a great goal to have, but it doesn’t really speak to how you will get there.

A SMART goal would be to decide to pay an extra $2000 this calendar year on an outstanding student loan balance. Break that amount down into 12 monthly payments and the goal becomes making 12 extra payments of $167 each to the student loan servicer. It’s smart because it is a good idea to eliminate this kind of debt by age 40. It’s measurable because there is a total dollar amount goal of $2000 in additional payments. It’s achievable because a budget can be adjusted to find the $167 every month. It is relevant because you still have to make student loan payments. And it’s time-bound because you know at the end of the year you should have made an additional $2000 in student loan payments.

Financial goals also fall into three different categories. There are long-term goals, midterm goals and short-term goals.

Long-Term Goals

These are goals you want to achieve sometime in the next 10 years. These are usually larger financial goals like pay off the mortgage on the house or buy a condominium at the beach.

Midterm Goals

These are goals that take anywhere between three and 10 years to achieve. These goals may be things like pay off all high-interest credit card debt or boost retirement savings by another $5000.

Short-Term Goals

These are financial goals you can reach relatively quickly. Maybe you want to save for a new washer and dryer or maybe pull together the money for a vacation to Bermuda.

Now it’s time to write down the financial goals by 40 you want to achieve and begin putting in place the steps to get there.

Goal Setting Work

Go ahead and write down your financial goals by 40. You can get a clearer picture of what you want if it is right there in front of you. Some people like to set a goal chart and track their progress that way. Under each goal determine if it is long-term, midterm, or short-term. Then make a list of the detailed steps it will take you to get from goal to accomplishment. Keep the SMART guidelines in mind as you block out each step.

Then review the steps toward the goals. You may see a pattern emerge. You may need to spend less in some places and spend more in others. You may need extra income to get to a particular step. That’s when it’s time to set up a budget that includes funding the steps to the goals.

Budgeting

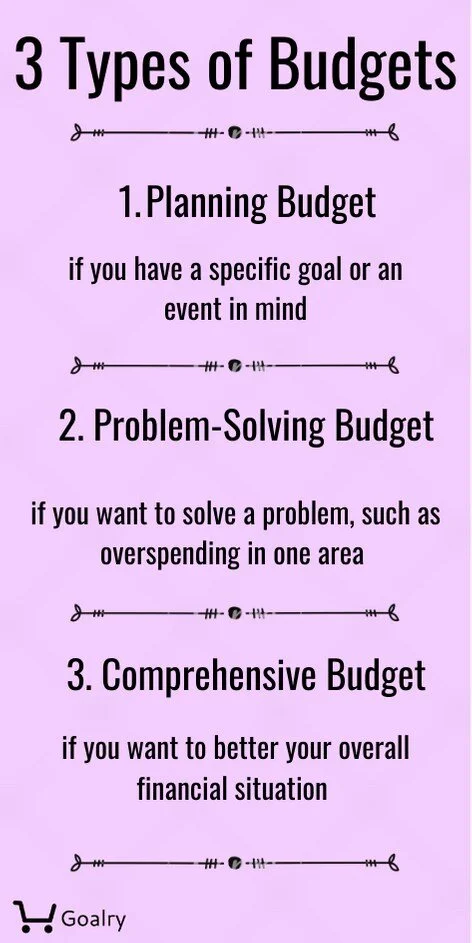

A budget is a helpful tool for reaching your financial goals by 40. When you create a budget you detail the money that is coming in and the money that is going out. There are three types of budgets:

Planning Budgets-These are budgets that are designed to fund a specific category or a specific thing. This kind of budget can be used to earmark money for a special tenth-anniversary vacation or to eliminate the balance on a specific credit card.

Problem-Solving Budgets-These budgets rearrange money to fund specific problem areas. This kind of budget can be used to reduce student loan debt by a certain amount or cut back on takeout food and restaurant meals.

Comprehensive Budgets-These are big-picture budgets designed to increase your overall finance fitness. A comprehensive budget might investigate all categories to look for places to decrease spending and increase saving.

Whether you create a budget on a pad of paper, a spreadsheet, or through an app, you get a visual feel for categories that can be adjusted. Maybe entertainment expenses can be reduced a bit to funnel another $50 one step more toward a goal. Maybe eliminating two designer handbag purchases a year frees up $350 toward retirement savings.

An important budgeting step is tracking expenses along the way. At the end of each day look and see if you spent money needlessly or carelessly and if you would feel better if those tens and twenties had been applied instead to a financial goal.

If your budget calls for funneling money into savings, make sure the money is accessible to you but not too accessible. If you’ve put away an extra $500 in a savings account to pay toward student loan debt it shouldn’t be tied to a debit card in your wallet. In a weak moment, you could end up making an impulse buy with your savings.

The same thing goes for the emergency fund you set up as one of your financial goals by 40. You should be able to tap into it if your HVAC unit needs to be replaced but not have it at your fingertips when you are shopping online.

Be Realistic With Your Goals

Don’t let your goals appear so far out of reach that there’s no way you can achieve them. For some people, a goal like getting entirely out of debt is really beyond any long-term plan. If getting out of debt means paying off five credit cards with balances, clearing $10,000 worth of student loans, paying the car note in full, and paying off the mortgage then that is a lot of work for one person at a time.

Break your goals down into smaller pieces and look at what could realistically get done. Maybe the first goal is to pay off one credit card balance. Maybe another goal is to increase the frequency of student loan payments to twice a month. Perhaps a less expensive car would lower the monthly payments.

It’s okay to set goals that are slightly out of reach. After all, you’re trying to get to a place where you haven’t been before.

Keep Evaluating Your Goals

Your goals, just like your budget and all of your finances, can be fluid things.

You might already be reaching goals and checking them off your list. Maybe a high-interest credit card is paid in full and locked up in your strongbox. Maybe you accelerated your car payments and you own it outright. Maybe you successfully maximized your retirement savings contributions for a full year. Congratulate yourself on your successes and look forward to the next goal you reach. But goals can certainly change over time.

That vacation you wanted to take might not seem so urgent now. You may have decided that your house really has enough space and you’re not going to buy something bigger and more expensive next year.

You might decide to replace one of those goals with new goals like $2500 into a 529 account for future college expenses. Or maybe saving for a remodel of the kitchen makes more sense than moving in five years.

Goals can be moving targets. Your priorities may change. Your vision for your future may change. It’s okay to allow your goals to change with them. You will be more motivated to work toward the goals that mean the most to you.

Reach Your Financial Goals with Goalry

Budget Better, Build Wealth, Get Out of Debt

Conclusion

By the time you reach 40 you have already done so much but there is still so much more ahead. You don’t want to come up short of cash or mired in debt in middle age and beyond. Some of your financial goals by 40 include saving enough money in an emergency fund for inevitable extra expenses. Making regular contributions into a retirement savings debt. Managing debt down to a low point. Investing money and not leaving it in a low-yield account. And planning for the future by crafting a will, evaluating special circumstance insurance as well as life insurance.

Plan to succeed and reach your goals by writing them down and planning the detailed steps it will take to reach each financial goal. Make sure the goals are reasonable so you don’t give up. Be realistic about whether the goals can be achieved in the long-term, midterm, or short-term. Most goals will require setting up and adjusting a budget to funnel money into the avenues that best meet your goals. Celebrate your successes as you reach milestones and keep re-evaluating your goals. Your plans, your dreams, and the things that are important to you will change over time.

And most of all, enjoy your 40s.