Many of us learned how to handle money from our parents, mainly by watching how they spent and saved money. Rarely are there real lessons around the best way to save and spend money. This results in many of us having to figure it out when we are adults and often after we have made a series of mistakes. Continue reading this article to learn more about how investing works and help you build your wealth.

Read MoreAre you tired of never having enough money? Have you worked for years and don't see the light at the end of the tunnel? If so, learning new wealth-building options will help you. These strategies maximize your potential earnings and help you fight your way out of debt.

Read MoreIf you are still a young adult, and especially if you are in your twenties, you are in luck because planning for your mid-term financial goals and then taking the steps necessary to achieve them is well within your grasp.

So, let’s not waste any time here. Let’s talk about how you can make some money for your mid-term financial management goals.

Read MoreThe long-term security and financial stability of yourself and those you love shouldn’t be left to chance. Getting a financial planner is a great way to make sure that does not happen.

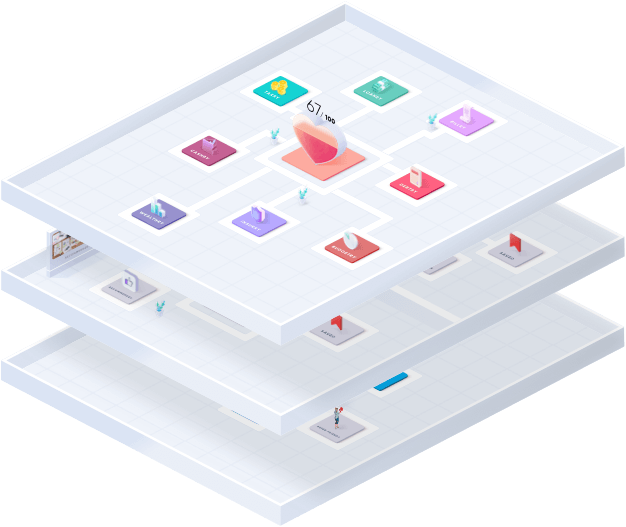

The best financial technology isn’t the one making your decisions for you. It’s the one making it easier for you to make those decisions with as much or as little information as you choose to consider and based on the factors you decide are important to you. Continue reading to see how an online financial goals planner can do this for you.

Read MoreHaving an idea in your head about starting a new business can be exhilarating. You probably feel like you have all the makings of a successful venture, but there's one problem: You don't have any money.

The good news is that you can learn how to start a business with no money. We'll provide you with 16 tips for starting a business with zero funds available.

Read MoreTo build financial wealth, you first have to understand what assets are and how to accumulate them. Certain types of assets have a certain value. Some are more valuable than others. To have a positive net worth means your assets are greater than your liabilities (debts). So let’s review the types of assets you need to build wealth and achieve your long term financial goals.

Read MoreOne of the major needs when setting financial goals is tracking them. You need to know where you stand and how far from your goal you remain.

This does not simply help you know whether you need to take on more work, it helps you show a bank or credit union that you present a credit-worthy financial situation. A personal financial statement helps you do this by helping you understand and monitor your goals.

Read MoreSetting goals for yourself is important, but making sure they are attainable is equally as important. Continue reading this article to find out more about setting proper rules and guidelines, or rules, to get you there.

Read MoreMost people want to change their financial situation. Unfortunately, they often fail because they treat the symptoms as opposed to the root cause: Their money mindset.

Your money mindset is made up of your beliefs and your attitude about money. It impacts the way you view money, feel about it, how you manage it, and more.

Read MoreIf you want to take control of your life, you will benefit from understanding and applying the principles of goal setting theory. The main premise of goal setting theory is, how well a person or an organization performs a task is directly related to goal setting.