If you go into debt to carry out a business idea or an undertaking, and you are under the assumption that you have adequately worked on the Business Plan and you are not improvising on it, you should assume that over time the same undertaking would probably result in excessive debt. This is when you need debt management solutions.

Read MoreWhen it comes to help saving money, using the budgeting tools that are exactly right for your wants, needs and plans is essential. Make sure you research and have the very best financial tools to build a goal planning (plan) that is so (strong) you can enjoy the confidence in knowing your financial life goals will never crumble down!

Read MoreYou opened a business. Now, you probably want to see it grow. You put in the work each day. You work weekends. Your friends might party, but you plan your next move. Your business savvy can pay off. You just have to make a plan, set some goals, make a budget, and stick to it.

You can use a simple, straightforward, everyday financial report called the balance sheet to help you plan and stay on track. This report lets you see at a glance how your business performs.

Read MoreTo build financial wealth, you first have to understand what assets are and how to accumulate them. Certain types of assets have a certain value. Some are more valuable than others. To have a positive net worth means your assets are greater than your liabilities (debts). So let’s review the types of assets you need to build wealth and achieve your long term financial goals.

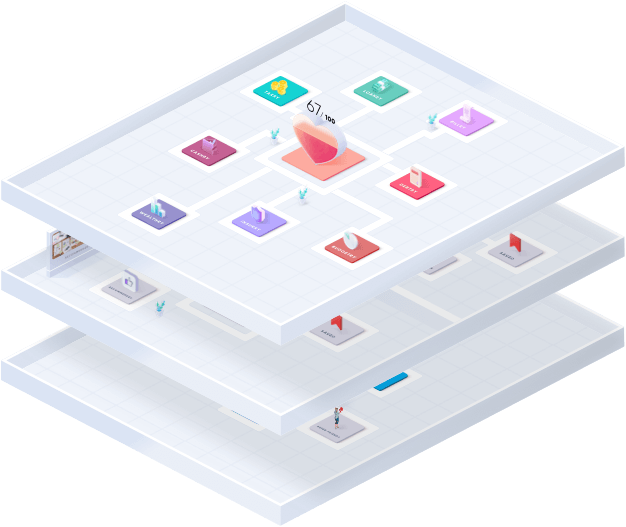

Read MoreOne of the major needs when setting financial goals is tracking them. You need to know where you stand and how far from your goal you remain.

This does not simply help you know whether you need to take on more work, it helps you show a bank or credit union that you present a credit-worthy financial situation. A personal financial statement helps you do this by helping you understand and monitor your goals.

Read MoreMany people do not pay attention to personal financial planning because they consider it to be a waste of time, or they tried to do it the previous year, but a few months after starting their planning, it did not work.

There are certain personal development goals that you should consider as it relates to your finances. We will now dive into some of them.

Read MoreSetting goals for yourself is important, but making sure they are attainable is equally as important. Continue reading this article to find out more about setting proper rules and guidelines, or rules, to get you there.

Read MoreMost people want to change their financial situation. Unfortunately, they often fail because they treat the symptoms as opposed to the root cause: Their money mindset.

Your money mindset is made up of your beliefs and your attitude about money. It impacts the way you view money, feel about it, how you manage it, and more.

Read MoreYou will not reach your goals by hoping or wishing, and you definitely won’t get anywhere by whining or wishing things were different than they are. Sure, we’d all like to save money – but we’re barely keeping up paycheck to paycheck now. Besides, we have all that debt to pay down and all these different obligations. We’ll save eventually, sure, but... right NOW?

Yeah, right now. Whether it makes sense or not, let’s start saving today. The key to it all? Pay yourself first.

Read MoreIf you want to take control of your life, you will benefit from understanding and applying the principles of goal setting theory. The main premise of goal setting theory is, how well a person or an organization performs a task is directly related to goal setting.